How To Record Gambling Losses On Tax Return

To enter Gambling Losses in TaxSlayer Pro from the Main Menu of the Tax Return (Form 1040), select: Itemized Deductions Menu; Other Miscellaneous Deductions; Gambling Losses to the Extent of Gambling Winnings; NOTE: This is a guide on entering Gambling Winnings and Losses into the TaxSlayer Pro program. This is not intended as tax advice. Gambling Losses. You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040 or 1040-SR) PDF and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return. Claim your gambling losses up to the amount of winnings, as 'Other Itemized Deductions.' Yes, gambling winnings are fully taxable and must be reported on your Wisconsin income tax return. You may claim a credit on your Wisconsin income tax return for any Wisconsin income taxes withheld from your gambling winnings. You must report your gambling winnings even if Wisconsin income taxes are not withheld.

Play your tax cards right with gambling wins and losses

If you are gambling on sites such as vera & john SV which are safe and friendly then you have nothing to worry, but if you gamble at casinos, be sure you understand the tax consequences. The number of poker sets which are an indicative of both wins and losses can affect your income tax bill. And changes under the Tax Cuts and Jobs Act (TCJA) could also have an impact.

Wins and taxable income

How To Record Gambling Losses On Tax Return Policy

You must report 100% of your gambling winnings gotten at sites like cozino.com as taxable income. The value of complimentary goodies (“comps”) provided by gambling establishments must also be included in taxable income as winnings.

Winnings are subject to your regular federal income tax rate. You might pay a lower rate on gambling winnings this year because of rate reductions under the TCJA.

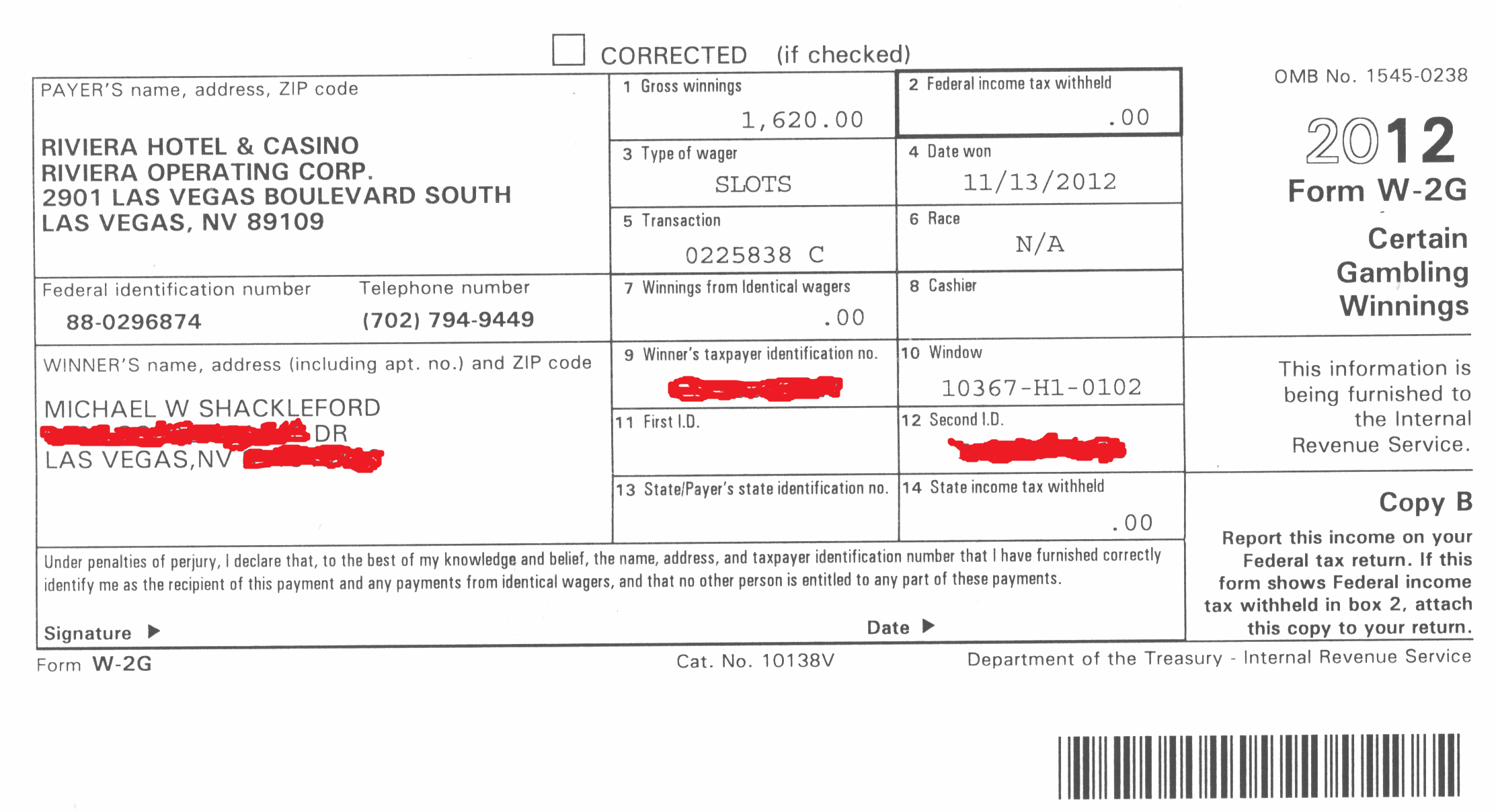

Amounts you win may be reported to you on IRS Form W-2G (“Certain Gambling Winnings”). In some cases, federal income tax may be withheld, too. Anytime a Form W-2G is issued, the IRS gets a copy. So if you’ve received such a form, remember that the IRS will expect to see the winnings on your tax return.

Losses and tax deductions

You can write off gambling losses as a miscellaneous itemized deduction, as stated in a report on www.piramindwelt.com. While miscellaneous deductions subject to the 2% of adjusted gross income floor are not allowed for 2018 through 2025 under the TCJA, the deduction for gambling losses isn’t subject to that floor. So gambling losses are still deductible.

But the TCJA’s near doubling of the standard deduction for 2018 (to $24,000 for married couples filing jointly, $18,000 for heads of households and $12,000 for singles and separate filers) means that, even if you typically itemized deductions in the past, you may no longer benefit from itemizing. Itemizing saves tax only when total itemized deductions exceed the applicable standard deduction.

Also be aware that the deduction for gambling losses is limited to your winnings for the year, and any excess losses cannot be carried forward to future years. Also, out-of-pocket expenses for transportation, meals, lodging and so forth can’t be deducted unless you qualify as a gambling professional.

And, for 2018 through 2025, the TCJA modifies the limit on gambling losses for professional gamblers so that all deductions for expenses incurred in carrying out gambling activities, not just losses, are limited to the extent of gambling winnings.

Tracking your activities

To claim a deduction for gambling losses, you must adequately document them, including:

- The date and type of gambling activity.

- The name and address or location of the gambling establishment.

- The names of other persons (if any) present with you at the gambling establishment. (Obviously, this is not possible when the gambling occurs at a public venue such as a casino, race track, or bingo parlor.)

- The amount won or lost.

You can document income and losses from gambling on table games by recording the number of the table you played and keeping statements showing casino credit issued to you. For lotteries, you can use winning statements and unredeemed tickets as documentation.

Please contact us if you have questions or want more information about the tax treatment of gambling wins and losses.

You can deduct losses you incurred from gambling on your tax return, but only up to the amount of your winnings.

Since gambling loss deductions are dependent on your winnings, you’ll need to report all the money you win from gambling to the IRS. This means you’ll have to include it in your taxable income when you file your tax return.

You must itemize your deductions to claim losses from gambling. Taxpayers who opt for the standard deduction are not able to claim their gambling losses.

Maintaining Records

You’ll need to keep accurate records of your gambling wins and losses if you want to claim your losses on your tax returns. The IRS requires you to keep track of the exchange of money from the following activities:

- Lotteries

- Raffles

- Races (horse/dog)

- Casino games

- Poker Games

- Sports bets

The records you keep should include:

- The date and type of gambling activity

- The name and location of the gambling establishment

- The people you gambled with

- The amounts won and lost

Your records should retain proof of your losses, should you be asked to provide it. Proof can include documentations such as:

- Form W-2G

- Form 5754

- Wagering tickets

- Canceled checks

- Receipts from the gambling location

Deduction limitations

You can’t deduct any gambling losses that exceed the amount you win and report as income. That means if you won $5,000 by gambling, but also lost $8,000 during the year, you’re only eligible to deduct $5,000. The remainder of the losses, totaling $3,000 cannot be written off or carried over to other years.

How to Report Losses

You can only claim gambling losses if you are eligible to itemize your tax deductions, using a Schedule A. You’ll itemize if all your deductions plus your gambling losses are greater than the standard deduction. If you claim the standard deduction, you’ll still need to pay tax on all your winnings and report the money you won, even though you won’t be able to claim deductions.

Claiming Losses On Tax Return

Gambling Losses Only

You can’t simply subtract the losses you incurred from your winning and report only the net profit or loss. You also can’t deduct losses without reporting winnings, so if you had a terrible year, it won’t get better at tax time. The IRS can’t allow this because otherwise it would be subsidizing taxpayer gambling.

Losing money while gambling won’t decrease your tax liability. First, you’ll need to win and then pay tax on the winnings before you can even consider a deduction of losses. So essentially, deducting losses only grants you the ability to avoid paying taxes on the money you win.